The Dragon Pattern is one of the most potent formations in CFD trading, offering traders a precise blueprint for identifying market reversals and momentum shifts. Steeped in historical significance and backed by technical analysis, this pattern has helped seasoned traders navigate turbulent markets with strategic confidence. By understanding its intricacies and applying it effectively, traders can unlock new opportunities in forex, stocks, and indices, transforming volatility into calculated advantage.

Understanding the Dragon Pattern in CFD Trading

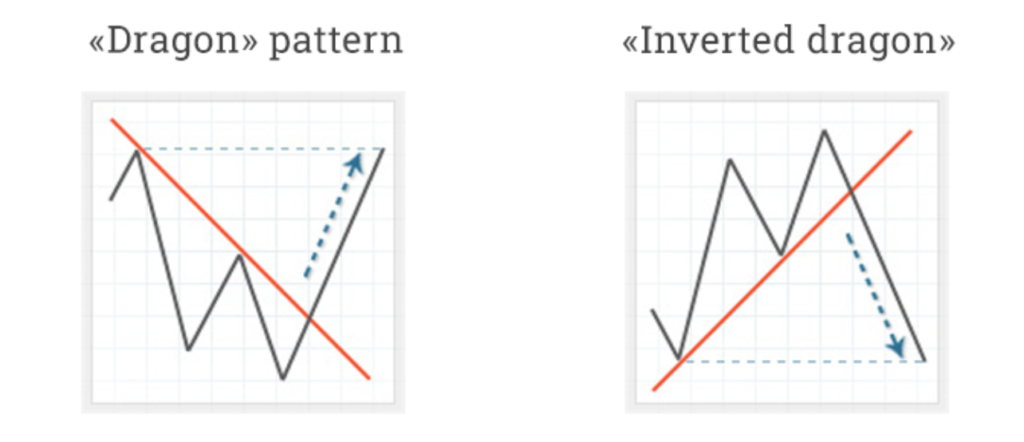

The Dragon Pattern is a technical reversal formation that helps traders anticipate shifts in market sentiment. It is built on principles of support, resistance, and momentum, acting as a reliable indicator of trend exhaustion before a breakout occurs.

The pattern consists of three key phases:

- The Drop (Dragon’s Tail) – A sharp decline in price, forming the first leg of the pattern. This downward move is often driven by selling pressure, weak economic indicators, or sudden market volatility.

- The Base Formation (Dragon’s Body) – Price stabilizes and consolidates at a support level, forming a distinct rounding bottom or W-shape. This phase represents accumulation, where buyers begin absorbing sell orders.

- The Breakout (Dragon’s Head) – A strong bullish push breaking past previous resistance levels, confirming the reversal.

Historical Examples of the Dragon Pattern in Market

Throughout financial history, reversal formations like the Dragon Pattern have played crucial roles in market recoveries and trend shifts. Below are key instances:

- The 2008 Financial Crisis Recovery: After the dramatic sell-off, indices such as the S&P 500 displayed clear accumulation zones, resembling the Dragon Pattern, before initiating a long-term recovery.

- The 2020 COVID Crash: In early 2020, major indices like the Nasdaq 100 formed deep corrective patterns before a sharp bullish reversal, resembling the Dragon Pattern in technical structure.

- Gold’s Major Reversals (2016 & 2022): Gold prices have historically shown rounded bottom formations, similar to the Dragon Pattern, before massive bullish trends unfolded.

Studying these past events equips CFD traders with insights into how market psychology influences price movement, helping them deploy the Dragon Pattern effectively in real-time trading.

Step-by-Step Guide: Identifying and Drawing the Dragon Pattern on MT4 & MT5

To correctly spot and plot the Dragon Pattern in MetaTrader 4 (MT4) and MetaTrader 5 (MT5), follow these steps:

Step 1: Identify the Dragon Pattern Formation

- Open MT4 or MT5 and navigate to your preferred CFD instrument (forex, stocks, indices).

- Switch to the H1 or H4 timeframes for clearer pattern visibility.

- Look for a steep price decline (Dragon’s Tail) followed by a gradual bottoming process (Dragon’s Body).

- Confirm the formation using support levels and oscillators (RSI, MACD) to validate accumulation zones

Step 2: Draw the Key Levels

- Select the Trendline Tool in MT4/MT5.

- Mark the lowest point of the pattern (Dragon’s Tail) and draw an upward trendline to the initial resistance level.

- Next, plot horizontal lines at significant support and resistance zones using the Rectangle Tool to outline the Dragon’s Body.

Step 3: Confirm Breakout Signals

- Use Fibonacci retracement levels to check for price reaction near the 38.2% or 50% retracement zones.

- Observe candlestick confirmation, such as bullish engulfing patterns or breakout candles forming the Dragon’s Head.

- Check for increased volume spikes to validate breakout momentum before entering a position.

Step 4: Execute the Trade

- Enter a CFD trade once price breaks above the resistance neckline with strong volume confirmation.

- Set a stop-loss below the Dragon’s Body for risk management.

- Use a target exit strategy, aiming for key resistance levels or Fibonacci extensions to lock in profits.

Why the Dragon Pattern Is Vital for CFD Traders

Unlike traditional asset trading, CFD trading allows traders to profit from both rising and falling markets. This makes reversal patterns like the Dragon Pattern particularly effective in high-volatility conditions.

Moreover, leveraged CFD trading enhances profitability potential—but also requires disciplined risk management. By integrating the Dragon Pattern into their strategy, traders can strengthen their ability to identify trend reversals, pinpoint entry points, and maximize returns across forex, stocks, and indices CFDs.

Learn More About CFD Trading with GVD Markets

If you’re ready to take your CFD trading skills to the next level, GVD Markets is here to help. With access to a Beginner to Pro Educational Academy, you can explore hundreds of video courses, live webinars, daily articles, and exclusive analytical tools designed to sharpen your trading strategy. Whether you’re just starting or looking to refine advanced techniques like the Dragon Pattern, GVD Markets provides a comprehensive trading environment with competitive conditions on oil, forex, stocks, cryptocurrencies, indices, and much more. Start mastering the markets today at gvdmarkets.com — where expert insights meet cutting-edge trading technology.

Start Trading with GVD Markets